In the ever-evolving world of cryptocurrencies, where digital gold rushes happen at the speed of light, purchasing a mining machine isn’t just about jumping on the bandwagon—it’s a strategic move towards financial independence and technological mastery. Bitcoin, Ethereum, and even the whimsical Dogecoin have transformed ordinary enthusiasts into potential tycoons, but only if they choose their tools wisely. A mining machine, essentially a powerhouse of processors designed to solve complex cryptographic puzzles, can be your gateway to this realm. Yet, amidst the buzz of blockchains and halving events, security and efficiency stand as the twin pillars that could make or break your investment. This checklist dives deep into those key points, ensuring that whether you’re eyeing a rig for Bitcoin’s robust network or Ethereum’s proof-of-stake transition, you’re armed with knowledge to navigate the pitfalls.

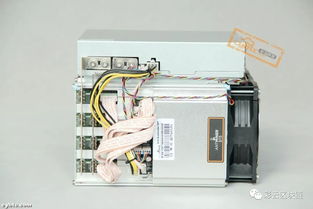

Picture this: rows upon rows of humming miners in vast data centers, each one a sentinel in the quest for the next block reward. When selecting a mining machine, start by evaluating its compatibility with various cryptocurrencies. For Bitcoin, which demands sheer computational might, you’ll want ASIC miners—specialized chips that outperform general-purpose hardware like GPUs favored by Ethereum miners. Dogecoin, built on a lighter Scrypt algorithm, might not require the same intensity, allowing for more accessible entry-level rigs. Diversity in your setup means not putting all your eggs in one basket; perhaps blend in a multi-coin miner that can switch between ETH and DOG as market winds shift. Remember, efficiency isn’t just about speed—it’s about adapting to the unpredictable nature of crypto markets, where a sudden surge in DOG’s popularity could render your BTC-focused rig obsolete overnight.

Security, often the unsung hero in mining discussions, demands your undivided attention from the outset. In an era where hackers lurk like shadows in the digital ether, a robust mining machine should feature built-in protections such as encrypted firmware and secure boot processes. Consider models that integrate with reputable exchanges for seamless, safeguarded transactions, minimizing risks like the 51% attacks that have plagued smaller coins. If you’re opting for hosting services, where your machine operates in a professional mining farm, verify the facility’s security protocols—think biometric access, 24/7 surveillance, and insurance against physical threats.

This layer of defense ensures that your investment in BTC or ETH doesn’t vanish due to external vulnerabilities, turning what could be a thrilling venture into a fortified fortress.

Now, let’s talk efficiency—the heartbeat of any mining operation. Hash rates, measured in terahashes per second for BTC miners, dictate how quickly you can compete in the global race for rewards. But don’t be fooled by high numbers alone; factor in energy consumption, as inefficient rigs can devour electricity faster than a Dogecoin meme goes viral, eroding your profits. Seek out machines with high efficiency ratios, like those certified for ETH’s energy-conscious upgrades, which promise lower operational costs and a greener footprint. Bursting with potential, a well-chosen miner not only crunches numbers but also scales with your ambitions, perhaps starting small with a solo DOG setup before expanding to a full-scale mining rig in a hosted farm.

Hosting your mining machine emerges as a game-changer for those wary of the technicalities or space constraints at home. By partnering with a reliable hosting provider, you gain access to state-of-the-art mining farms equipped with optimal cooling systems and stable power supplies, crucial for maintaining peak performance in ETH or BTC mining. This setup allows you to focus on strategy rather than maintenance, with providers often offering real-time monitoring and payout integrations to exchanges. Yet, burst through the hype and scrutinize contracts for hidden fees, uptime guarantees, and scalability options—after all, the crypto world thrives on adaptability, much like how DOG surprised the market with its resilience.

In wrapping up this checklist, remember that the path to mining success weaves through careful selection and foresight.

Whether you’re drawn to the stability of Bitcoin, the innovation of Ethereum, or the fun of Dogecoin, prioritizing security and efficiency will safeguard your journey. As you ponder your next move, consider consulting experts in mining machine sales and hosting; their insights could be the spark that ignites your crypto empire, blending technology, strategy, and a dash of daring into a rewarding tapestry.

One response to “Mining Machine Purchase Checklist: Key Points for Security and Efficiency”

A vital guide! Prioritize robust security features & energy efficiency metrics. Don’t overlook cooling needs or long-term maintenance costs. A smart checklist for savvy miners.