In the vibrant world of cryptocurrency, where fortunes can be made or lost in the blink of an eye, one of the most crucial elements for miners revolves around the delicate balance of power consumption and price. Among the various methods of mining, GPU (Graphics Processing Unit) mining stands out, significantly due to its higher efficiency in handling complex calculations necessary for mining cryptocurrencies like Bitcoin, Ethereum, and Dogecoin. Understanding the dynamics between GPU power consumption and its price can ultimately lead to optimized mining performance and increased profit margins.

To dive deeper into this subject, it’s essential first to understand what makes a GPU the heart of a mining rig. Unlike traditional CPUs, graphics cards are designed for parallel processing, making them far more adept at handling the hash functions that underpin the mining process. When considering power consumption, miners must pay attention to the energy efficiency of their GPUs—essentially how much power is drawn to produce a specific output. This metric is vital as electricity is one of the most substantial costs in a mining operation.

The price of GPUs has seen tremendous fluctuations over the past few years, impacted by the soaring interest in cryptocurrencies and the global semiconductor shortage. Miners often face a double-edged sword: high demand for GPUs drives up their prices, while the reduced availability means they have to evaluate whether the investment will yield enough returns to justify the costs. This situation brings us to the pivotal question of cost versus output, a central theme in the evaluation of mining profitability.

A successful mining operation hinges on selecting the right GPU models that strike a balance between purchase price, power consumption, and hashing power. For instance, some GPUs may be cheaper but could use a disproportionate amount of power relative to their computing output. As such, evaluating their hash rates becomes paramount. GPUs that provide the highest hash rates for the least energy consumed ensure a more profitable setup, ultimately leading to better positions in mining pools where rewards are shared based on computational contributions.

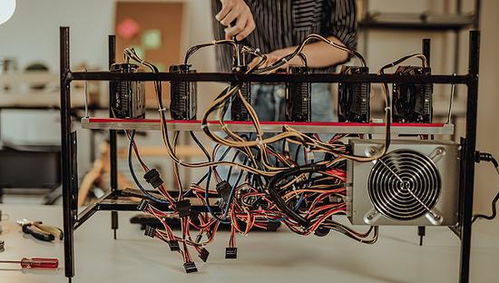

Furthermore, the advent of mining farms has transformed the landscape of cryptocurrency mining. These facilities host numerous mining rigs, often tailored specifically for maximum efficiency. By consolidating resources such as power and cooling, mining farms can significantly mitigate individual miners’ costs, transforming them into competitive powerhouses. Such an approach allows for the bulk purchasing of equipment, often at discounted rates, and gives the operation leverage to negotiate better electricity contracts.

Operating an efficient mining farm necessitates careful monitoring of GPU performance and energy consumption metrics. Different cryptocurrencies serve varying levels of profitability based on mining difficulty, the current market value, and the specific algorithm used. For example, Bitcoin, with its SHA-256 algorithm, generally requires ASIC miners for optimal performance, while Ethereum’s Ethash algorithm lends itself well to GPU rigs. This diversity in cryptocurrency mining ensures that miners must remain agile, often pivoting their strategies based on the ever-shifting tides of market conditions and profit margins.

Moreover, with the rise of new cryptocurrencies, miners are perpetually faced with the decision of whether to switch gears or remain loyal to their current preferred currency. The future of mining—especially as GPU models evolve—may involve more intricate choices that balance performance against long-term investment viability. Regulations, network upgrades, and environmental considerations regarding energy consumption further complicate these equations, requiring miners to stay informed and adaptive.

In conclusion, the landscape of GPU mining is an intricate interplay of power consumption, cost, and output performance. As the crypto market continues to mature, miners must leverage analytical tools and performance metrics to shape their strategies. The ultimate goal is simple yet profound: establishing a sustainable mining operation that thrives amidst volatility. Whether one is mining Bitcoin, Ethereum, or embracing the burgeoning Dogecoin community, every decision—from selecting the ideal components to adjusting operational parameters—counts toward fulfilling the promise of profitable crypto ventures.

One response to “Analyzing GPU Power Consumption vs Price for Optimal Mining Performance”

This article dives into the intricate balance between GPU power usage and cost, unveiling surprising insights that challenge common mining assumptions. From efficiency trade-offs to hidden expenses, it offers a multifaceted look at maximizing returns in cryptocurrency mining.